Let’s face it; business financial accounting is a fundamental process, which helps to determine the health status of your business as well as the likelihood of its potential growth. In accounting, different documents are used. One of the most important categories of files that the accounts team cannot and won’t do without is the profit and loss forms. These are files used to determine whether a business incurred profits or otherwise in a given period. If you are looking for the Financial Forms for business use, here is a list that you might find helpful.

Related:

Individual Income Tax Return 2020 Inst 1040 (Schedule R) Instructions for Schedule R (Form 1040 or Form 1040-SR), Credit for the Elderly or the Disabled 2020 Form 1040 (Schedule F) Profit or Loss From Farming 2020 Inst 1040 (Schedule B). The 2018 Instructions for Schedule C (Form 1040) are not being revised at this time. Instead, make the following two substitutions when using these 2018 instructions. 2018 Instructions for Schedule C, Line 26. The beginning of the instructions for line 26 is revised as. 2018 Instructions for Schedule C, Profit or Loss From Business. Forms and Publications (PDF) Instructions: Tips: More Information: Enter a term in the Find Box. Select a category (column heading) in the drop down. Form 11-C: Occupational Tax and Registration Return for Wagering 1217 « Previous. A profit and loss statement is a financial document used by businesses to evaluate the financial status of their company within a given time period. Within this specified period of time, usually a quarter, a profit and loss statement lists all of the accounts receivable and accounts payable of a business.

Sample Profit & Loss Statement Form

A profit and loss statement form shows you whether you’ve made profits over a given period. Otherwise, you should record the data down for analysis and business forecasting. You may also see Business Financial Statement Forms.

Self Employment Profit & Loss Form

If you are self-employed, this sample file is for you. It makes it possible for you to track how much profit or loss you make from your business after every set period. Download the file for free today.

Downloadable Profit or Loss Business Form

Doing business can be risky, it always is. At the end of the day, you are not sure whether you will make profits or losses. However, you need a profit or loss from business form to do the analysis before arriving at the conclusion.

Blank Profit and Loss Form in PDF

Free Printable Profit Loss Forms

The one thing that makes this template special is that you can download it for free. Also, you don’t have to spend a lot of time customizing it because it is already available for immediate print. You can also see Financial Statement Forms.

Quarterly Profit & Loss Statement Form

This template is best for businesses that often conduct their financial accounting process at the end of every three months. The results can be used to make changes to your business and bring about improvements over time.

Personal Profit and Loss Statement Form Format

If you are in your own business, it would be great if you use a personal profit and loss account for financial accounting after every period that you’ve set for the task. You can download the file by following the link below.

Profit and Loss Statement for Small Business Form

This sample form is suitable for small businesses that don’t have a lot of financial accounting needs on a month to month basis. Use this for small business accounting.

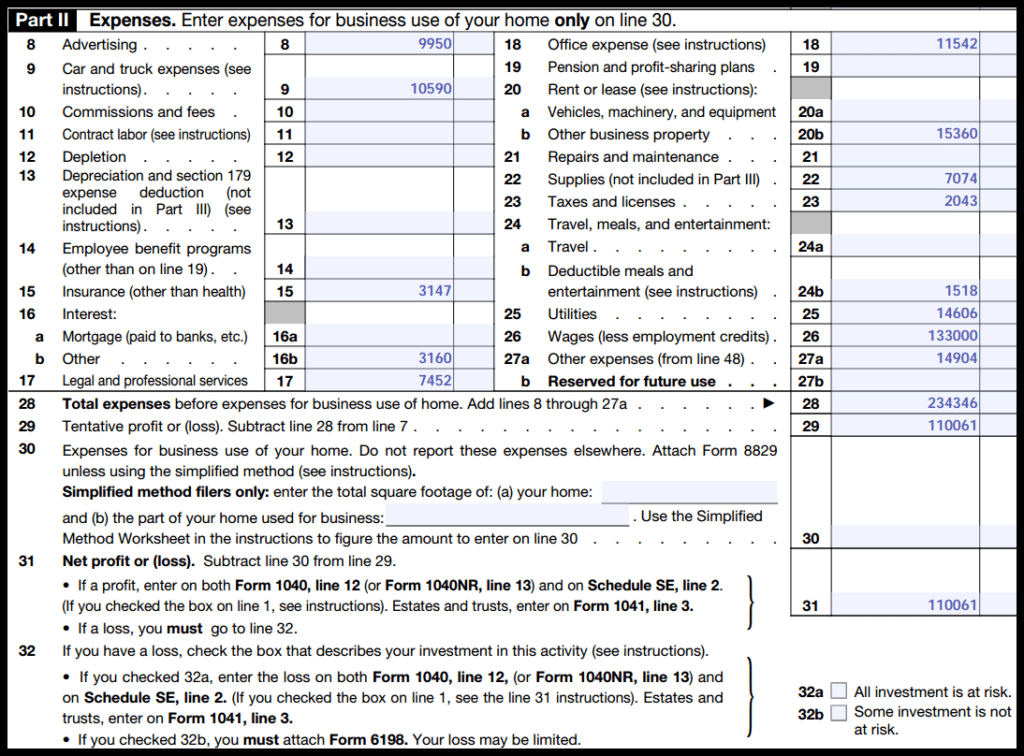

2018 Profit And Loss Schedule C Form

Free Monthly Profit & Loss Statement Form

If you would rather conduct a monthly financial accounting, this will be the best sample file to use. It is suitable for personal businesses as well as small businesses that are growing rapidly. You may also see Sample Income Statement Forms

Example of Profit and Loss statement Form for Self-Employed

The profit and loss account for self-employed persons is a free sample form available for free download. You use this template if you do not have time to create your own design from scratch.

Simple Profit and Loss Statement

What are The Uses of Profit and Loss Forms?

- Conduct the analysis, compile the results, and then write a financial report for the period specified. Use the report you just wrote to determine whether your business made profits or incurred losses over the given period.

- You can use the profit and loss data to do business forecasting. Business forecasting is the art where you determine the future of your business based on the current financial statistics. Of course, although the forecast is not always accurate, it can help give you the idea about your business in the terms of a future placement.

What are The Benefits of Profit and Loss Forms?

- Every file in this thread is free to download. In fact, you don’t need a template builder. Also, you don’t need to hire someone to create these files for you. At the end of the day, you save time and money.

- These templates can be used as is. It means you do not really have to customize them after download. Instead, you should start doing your accounting immediately. Because these files are designed to make your work easier, it is important that you take advantage of them every time you want to conduct a financial analysis for your business.

With many sample profit and loss files for different audiences already available on this page, there is no real reason why you should even think of creating these files from scratch. The term different audiences in this context mean individuals, companies, and small businesses that must use these files for accounting. You can also see Financial Evaluation Forms.